Quantitative easing (QE) is essentially the act of monetizing debt. The Fed basically prints dollars and then uses those dollars to purchase Treasury debt. Currently, the Fed is the largest purchaser of U.S. debt. With QE2 scheduled to end around June of this year, demand concerns are certainly arising. What buyer will pick up the Treasury purchasing slack to finance U.S. debt? Will they do it at the paltry yields currently being offered?

There is a serious possibility that rates on Treasury bonds will get pushed up by the market in order to find buyers who desire a better yield to hold U.S. debt. This would push the price of bonds down, which provides the better yields.

Remember, when yields rise, existing bonds see their price go down and vice versa.

This scenario would add pressure to the credit markets on a whole providing a rising force on interest rates on a whole, causing an increase in the cost to borrower. Certainly a drag the economy could do without in the future.

However, if we get a rise in overall yields (interest rates) then fixed income investments will become more attractive thus providing better return on our investments in that assets class, assuming you plan to hold until maturity on a bond for instance.

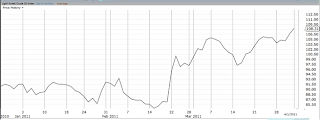

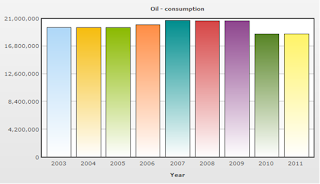

My real concern is as a consumer! Monetizing debt is a task that generally devalues a currency. As the US Dollar weakens the cost of imported goods rises since the currency does not have the same purchasing power it did in the month or quarter before. A specific example is the rising price of crude oil, which most folks recognize when paying higher prices at the gas pump. The following chart shows the rising price action of Light Sweet Crude Oil in 2011, during which time the Fed has been working its QE2 magic. After rolling sideways to start the year, we have seen roughly an 18 percent spike in prices in Q1, with all off that occurring in the last six weeks of the quarter. The Fed has been in full print and purchase mode throughout this period.  This notion becomes a bit more clear when you consider that increasing prices are supposed to be caused by increased demand, meaning too many dollars chasing too few goods. The problem with that equation here is that U.S. Oil demand has not increased. The accompanying chart shows that average demand actually fell in 2010 and is flat thus far in 20011. Yet the cost for all energy related goods, such as gasoline and heating oil, has increased.

This notion becomes a bit more clear when you consider that increasing prices are supposed to be caused by increased demand, meaning too many dollars chasing too few goods. The problem with that equation here is that U.S. Oil demand has not increased. The accompanying chart shows that average demand actually fell in 2010 and is flat thus far in 20011. Yet the cost for all energy related goods, such as gasoline and heating oil, has increased.

The positive side of QE2 coming to an end in June is that the U.S. dollar will likely strengthen, helping to atleast NOT promote rising commodity prices. This assumes of course that the Fed’s language doesn’t have the markets thinking QE3 is right around the corner.

The positive side of QE2 coming to an end in June is that the U.S. dollar will likely strengthen, helping to atleast NOT promote rising commodity prices. This assumes of course that the Fed’s language doesn’t have the markets thinking QE3 is right around the corner.

The bottom line is, no matter the outcome, with knowledge we can be prepared to adjust our investment strategies accordingly and even our spending habits if so desired.

I look forward to searching for gold related investments if we do see a spat of inflation, along with analyzing fixed income instruments and the improved yields they will offer if we see interest rates rise. Either scenario, appropriate investments exist to better manage your financial future.

Your hoping the Fed stops the printing press analyst, Mitch Jaworski